Dealing with the increase

in the cost of living

In short

Prices have skyrocketed with the pandemic. Everything costs more, with food first in line. But you can reduce your food bill. For example, you can:

- Decide to eat less meat, which has risen significantly

- Prepare your own meals as often as possible and eat out less

- Check the flyers to see what’s on sale

- Avoid waste

You can also take a look at your other expenses to see what can be reduced, for example:

- Renegotiate your insurance, telecommunications and subscriptions

- Eliminate services that are no longer needed

- Buy less or second hand

Certain actions can also help your wallet while benefiting the environment. For example, reduce your energy consumption and use public transportation to get around.

Finally, there’s nothing better than regularly reviewing your budget.

Reduce your grocery bill

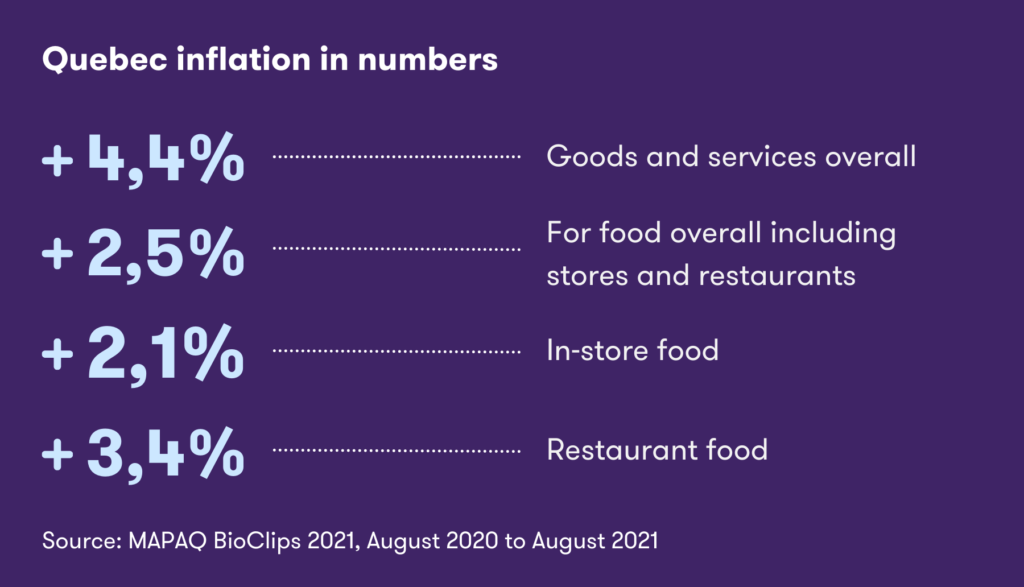

Of all the commodities, food is the one whose retail price increased the most in 2020 (+ 2.3%). It doesn’t look there’ll be any improvement in 2022. Many of us are working from home, which means people are eating at home more often. Reducing the grocery bill should therefore be a priority. To do this, you have to learn a few tricks, but also change your consumption habits.

For examples, the price of staples like eggs, flour, sugar, pasta and milk has not increased significantly, while products like meat have gone up considerably. So, have some fish instead of a steak. Add more legumes to the menu, they’re tasty and inexpensive. Prepare your own meals as often as possible. If you go to the office, bring your lunch and avoid prepared meals. Lastly, keep your visits to the restaurant for special occasions.

Plan your purchases

Check flyers to see what’s on sale before you head out to the store. You could plan your meals for the week accordingly. Sometimes, driving a little out of the way to a grocery store that’s a bit further from home may well be worth it. When you shop, pick the store brands and large sizes if you have a family. Try to avoid waste, freeze the leftovers.

Clean up your finances

Cutting your grocery bill will help you stay within budget, but you should also take a look at your other expenses. Take some time to renegotiate your insurance (the ClickInsurance price comparer is very efficient), telecommunication services (internet, cellular, television) and subscriptions (gym, magazines, online movies). If you’re not using them much, cancel them. Sell items you’re not using any more. Before you buy something, ask yourself if you really need it and buy second hand when you can. Lastly, use your points and any gift cards you may have.

Good for you, good for the planet!

Think about reducing your energy consumption by raising the whole family’s awareness. Choose public transportation, bicycles and ride-sharing to get around. This will have a positive impact on your wallet and the environment!

Lastly, stick to good financial habits: review your budget regularly, only use your credit card if you can pay the balance each month and consolidate your debts.

You’re in a tight spot because of rising prices and you don’t see a way out? Contact one of our financial recovery counsellors. They can help you take control of your finances.

Online budget

Apps to help you save

There are a number of apps that can help you save considerably while avoiding food waste. Here are some of them:

- FoodHero (IGA, Metro) and Flashfood (Maxi, Provigo) suggest items that are close to their expiration date at a fraction of the cost. Simply place your order online and pick it up in the store.

- Too Good To Go lets you buy surprize bags with unsold surplus food at very low prices. You pick up the items at the time and place indicated.

- Frigo Magic helps you use up food in your refrigerator. Use the app to select items and you’ll receive recipe suggestions.

- Flipp et Reebee give you access to most online flyers so you can save.

Meet with one of our counsellors for free

Don’t ignore a debt problem that’s ruining your life. Let’s work together to help you regain control of your finances.